Understanding DDP: Definition, Misconceptions and Benefits of Delivered Duty Paid Shipping

When it comes to international shipping, there are various incoterms used to define the responsibilities of buyers and sellers.

One such term is Delivered Duty Paid (DDP), which has gained popularity among businesses due to its simplicity and cost-effectiveness. In this blog post, we will delve into the concept of DDP, how it works, its advantages, benefits, and dispel common misconceptions about this incoterm.

Additionally, we will highlight how DIDADI can simplify your DDP international shipping process.

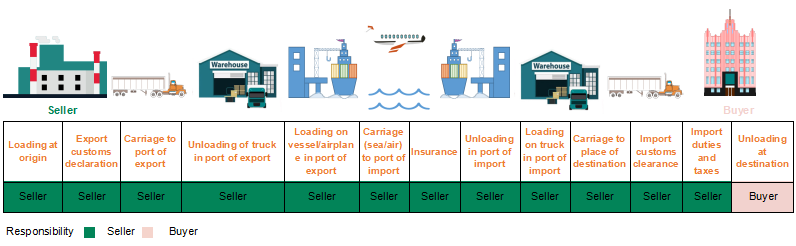

DDP stands for Delivered Duty Paid, an incoterm that defines the responsibility of the seller to deliver goods to the buyer at their destination, including all customs duties and taxes owed on the shipment.

The seller assumes all risks and costs associated with transporting the goods until they reach the buyer’s doorstep. Once the goods are delivered, the buyer takes ownership of them.

Seller prepares the shipment: The seller packages the goods according to the buyer’s specifications and arranges for transportation

Seller prepares the shipment: The seller packages the goods according to the buyer’s specifications and arranges for transportation.

Seller clears customs: The seller pays all customs duties and taxes on behalf of the buyer before delivering the shipment to the carrier.

Carrier transports the shipment: The carrier picks up the shipment from the seller and delivers it to the buyer.

Buyer receives the shipment: The buyer takes possession of the goods once they have been delivered by the carrier.

.

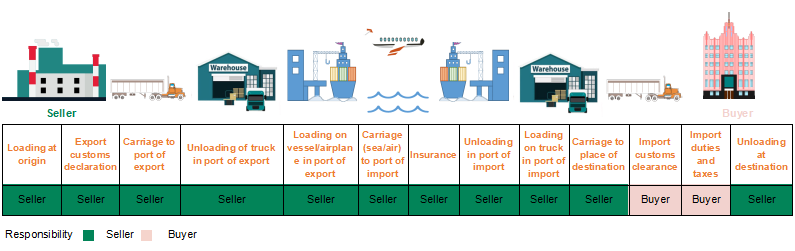

To understand DDP better, let’s compare it with two other commonly used incoterms: DDU (Delivered Duty Unpaid) and DAP (Delivered At Place).

DDU

DDU means that the seller delivers the goods to the buyer at their destination but doesn’t pay any customs duties or taxes. The buyer must pay these fees before taking possession of the goods.

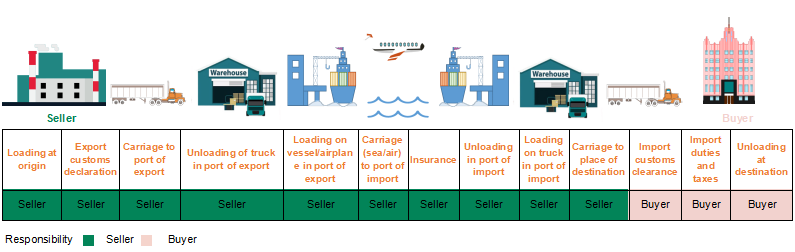

DAP

DAP, on the other hand, means that the seller delivers the goods to the buyer at their destination and also pays all customs duties and taxes. However, the seller only pays the duties and taxes up to the point where the goods enter the country of destination; any additional charges beyond that point are paid by the buyer.

There are several reasons why businesses prefer using DDP over other incoterms:

Simplified logistics: With DDP, the seller handles all aspects of delivery, including customs clearance, making it easier for buyers to manage their supply chain.

Cost savings: By paying customs duties and taxes upfront, sellers can avoid additional charges that might be passed onto the buyer if they were to use DDU or DAP.

Faster delivery times: Since the seller clears customs on behalf of the buyer, DDP shipments tend to arrive faster than DDU or DAP shipments.

Reduced risk: As the seller assumes all risks and costs associated with transporting the goods, buyers face less risk when using DDP.

Despite its many benefits, some businesses still harbor misconceptions about DDP. Here are a few myths debunked:

Myth #1: DDP is only suitable for small shipments.

Reality: DDP can be applied to shipments of any size, whether large or small.

Myth #2: DDP is more expensive than other incoterms.

Reality: While the seller pays customs duties and taxes upfront, the overall cost of using DDP may actually be lower than other incoterms since the seller absorbs all risks and costs associated with transporting the goods.

Myth #3: DDP requires special permits or licenses.

Reality: No special permits or licenses are required to use DDP; however, the seller must comply with all relevant laws and regulations regarding customs clearance.

At DIDADI, we understand the complexities of international shipping and strive to simplify the process for our clients. Our platform offers a range of tools and services designed to streamline your DDP experience, including:

Customs Clearance: We handle all aspects of customs clearance on your behalf, ensuring that your shipments are cleared efficiently and accurately.

Tax Calculator: Our built-in tax calculator helps you estimate duty and tax liabilities upfront, so you can budget accordingly.

Shipping Rates: Compare rates from top carriers worldwide to find the best option for your needs and budget.

Document Preparation: We prepare all necessary documents, including commercial invoices, bills of lading, and certificates of origin, to ensure smooth customs clearance.

In conclusion, understanding DDP and how it differs from other incoterms like DDU and DAP can greatly benefit businesses looking to expand their global footprint.

By leveraging DDP, companies can reduce costs, simplify logistics, and mitigate risks associated with international shipping. To make your DDP experience even smoother, consider partnering with DIDADI Logistics– your one-stop solution for all things related to international shipping.

Recommended Reading