A Comprehensive Guide to Incoterms: Simplifying International Trade

Incoterms, short for International Commercial Terms, are a standardized set of rules developed and maintained by the International Chamber of Commerce (ICC) to facilitate smooth international trade.

They serve as a common language for buyers and sellers across different countries and cultures, clarifying who bears the risks and costs associated with the transportation and delivery of goods.

By defining the obligations and responsibilities of each party, Incoterms provide clarity and certainty in international contracts.

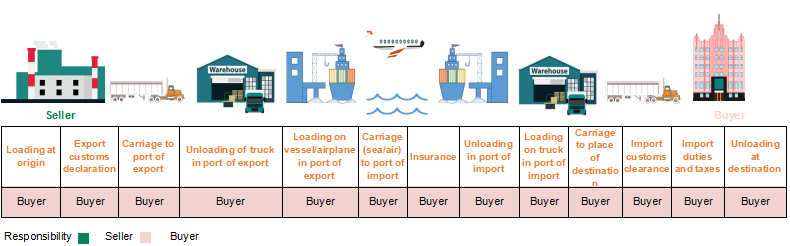

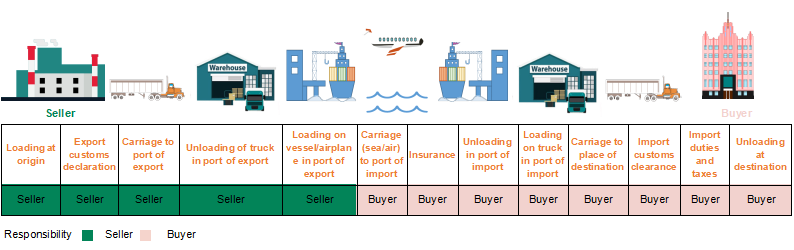

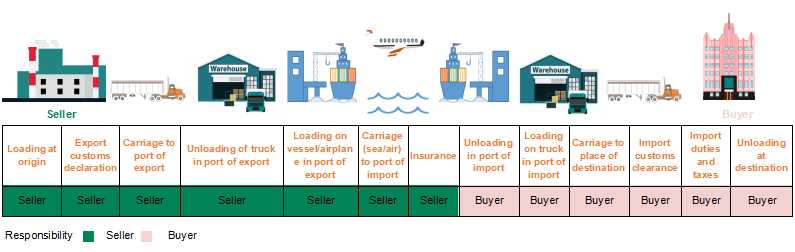

EXW stands for “Ex Works”. It represents the minimum obligation and responsibility for the seller in an international trade transaction.

When a transaction is conducted under the EXW Incoterm, the seller fulfills their obligations by making the goods available at their premises or another agreed-upon location, such as a factory or warehouse.

The seller’s responsibilities under EXW include:

Making the goods available at a specific location agreed upon with the buyer.

Ensuring that the goods are ready for the buyer to pick up or collect.

Providing the necessary documentation related to the goods, such as commercial invoices or export licenses.

test

The buyer’s responsibilities under EXW include:

Arranging and paying for the transportation of the goods from the seller’s premises to the desired destination.

Handling export formalities and obtaining any necessary licenses or permits.

Assuming all risks and costs associated with the transportation, including insurance, customs duties, and taxes.

It’s important to note that under EXW, the seller’s obligations end once the goods are made available to the buyer. The buyer bears all subsequent risks and costs, including any potential delays or damage during transportation.

EXW is commonly used when the buyer has a strong logistical setup and control over the transportation process or when the goods are bulky or require special handling. It places a significant burden on the buyer in terms of logistics, as they have to manage the entire transportation process.

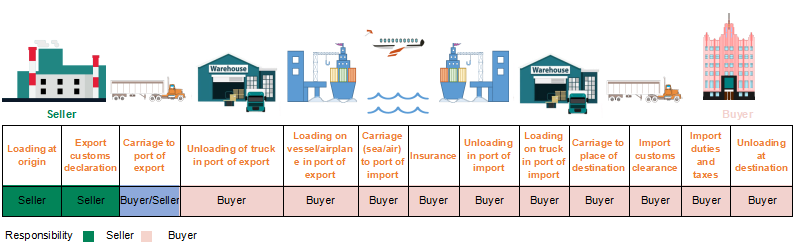

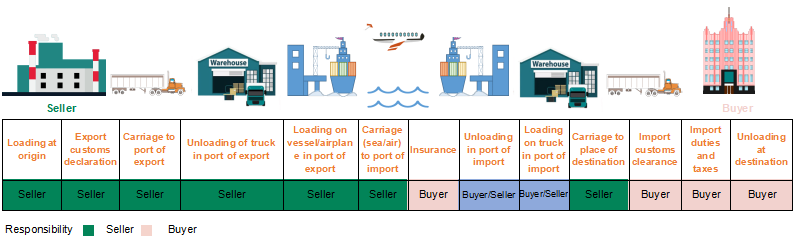

FCA stands for “Free Carrier”. Under the FCA (Free Carrier) term, the responsibilities between the seller and the buyer are as follows:

Prepare the goods for export and deliver them to the carrier or another designated person at the agreed-upon place.

Complete export customs formalities, if applicable.

Provide the necessary documentation to the buyer, such as the commercial invoice, packing list, and export license or customs declaration.

Receive the goods at the agreed-upon place of delivery.

Arrange and pay for the main transportation of the goods from the named place of delivery.

Assume the risk of loss or damage to the goods once they have been delivered to the carrier.

Handle import customs clearance procedures, pay any applicable duties or taxes, and complete any necessary import formalities.

Provide the seller with any required information or documents for export or import purposes.

The FCA term is often used when the seller is responsible for delivering the goods to a specific location or carrier, either at their own premises or another designated place.

This term is particularly suitable when the seller has the necessary facilities and expertise to arrange for transportation, such as loading the goods onto a truck, preparing them for export, or delivering them to a specific port or airport.

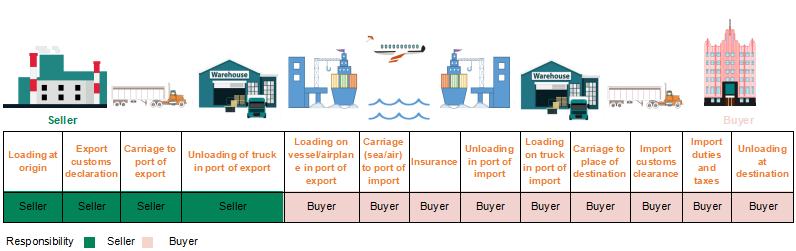

FAS refers to “Free Alongside Ship”. Under the FAS Incoterm, the seller is responsible for delivering the goods alongside the vessel at the specified port of shipment. This means that the seller must ensure that the goods are ready for loading onto the ship, cleared for export, and placed at the designated location alongside the ship.

Here’s a breakdown of the responsibilities of the seller and buyer under the FAS Incoterm:

The seller’s responsibilities under FAS include:

Prepare and package the goods for export.

Deliver the goods alongside the vessel nominated by the buyer or their agent at the named port of shipment.

Arrange and pay for the loading of the goods onto the vessel.

Complete export customs formalities.

Provide the buyer with the necessary documentation, such as the commercial invoice, packing list, and export license or customs declaration.

The buyer’s responsibilities under FAS include:

The buyer is responsible for paying the price of the goods as agreed upon in the contract of sale.

Handling all import customs formalities, obtain any necessary import licenses or permits, and pay any applicable customs duties or taxes.

Bearing the costs and risks associated with loading the goods onto the vessel, as well as any subsequent transportation and insurance.

The buyer takes delivery of the goods once they are delivered alongside the ship at the named port of shipment. From that point onward, the buyer assumes responsibility for the goods.

FOB stands for “Free On Board” or “Freight On Board”. The FOB term is often followed by a specific location, such as FOB Shanghai or FOB Port of Los Angeles, indicating where the seller’s responsibility ends.

It is important to note that the exact details and obligations under FOB terms may vary depending on the specific agreement between the buyer and seller, as defined in the contract or sales agreement.

The responsibilities between the seller and the buyer are as follows:

Delivering the goods to the specified location agreed upon in the contract.

Loading the goods onto the agreed-upon mode of transportation.

Arrange and bear the costs associated with export customs clearance procedures, including documentation and compliance with export regulations.

Ensure that the goods undergo pre-shipment inspection or any other quality control measures specified in the contract.

The seller is responsible for the costs incurred in preparing the goods for shipment and transporting them to the point of loading. This includes packaging, labeling, and inland transportation costs.

The buyer’s responsibilities under FOB include:

Once the goods are loaded onto the mode of transportation, the buyer assumes responsibility for the shipment, including any costs, risks, and insurance associated with further transportation.

Arranging and covering the costs of import customs clearance procedures, which may involve obtaining necessary permits, paying duties, and complying with import regulations.

Unloading the goods and transporting them to the final destination.

Paying any applicable import taxes, duties, or other charges imposed by the customs authorities of the importing country.

Insurance: It is generally the buyer’s responsibility to insure the goods during the transportation period from the point of loading until delivery.

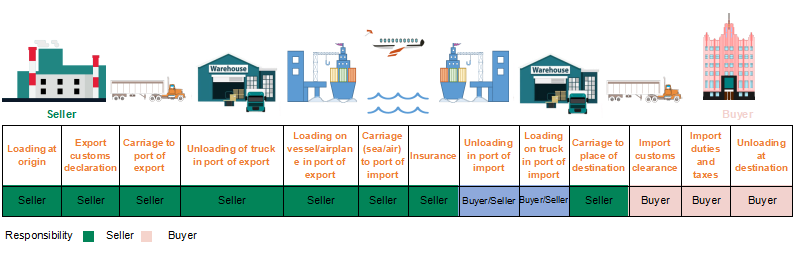

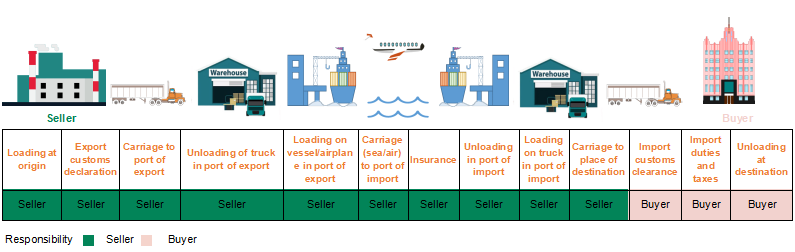

CPT stands for “Carriage Paid To”. This specifically relates to the delivery of goods from the seller to the buyer. According to the CPT Incoterm, the seller is responsible for arranging and paying for the main carriage of the goods to the agreed-upon destination.

Once the goods are delivered to the carrier, the risk of loss or damage transfers from the seller to the buyer. The buyer is responsible for any subsequent transportation, import clearance, and any applicable taxes or duties upon arrival at the destination.

The seller’s responsibilities under CPT include:

Deliver the goods to the carrier or another designated person at the agreed-upon place of shipment.

Arrange and pay for the main carriage of the goods to the named place of destination.

Obtain any necessary export licenses or documentation.

Provide the buyer with the required documents, such as the invoice, packing list, and transport document.

The buyer’s responsibilities under CPT include:

Receive the goods once they have been delivered to the named place of destination.

Bear the risk of loss or damage to the goods from the time they have been delivered to the carrier.

Arrange and pay for any subsequent transportation beyond the named place of destination.

Handle import clearance procedures and pay any applicable customs duties or taxes.

Provide the seller with any necessary information or documents required for the transportation and import clearance of the goods.

CIP stands for “Carriage and Insurance Paid To” in shipping. Under CIP terms, the seller is responsible for arranging and paying for the main carriage of the goods to the named destination, as well as providing insurance coverage.

The responsibilities between the seller and the buyer are as follows:

The seller’s responsibilities under CIP include:

Arrange and pay for the main carriage of the goods to the named destination.

Select and engage the carrier or transportation service provider for the transportation of the goods.

Complete export customs formalities

Provide the necessary documents, such as the commercial invoice, packing list, and transport document, to the buyer.

Obtain insurance coverage for the goods during transit and provide the buyer with the insurance policy or certificate.

The buyer’s responsibilities under CIP include:

Take delivery of the goods at the named destination.

Bear the risk of loss or damage to the goods once they have been delivered to the carrier or another designated person.

Arrange and pay for any subsequent transportation beyond the named destination.

Handle import customs clearance procedures, pay any applicable duties or taxes, and complete any necessary import formalities.

Provide the seller with any required information or documents for export or import purposes.

CFR stands for “Cost and Freight” in shipping. Under CFR terms, the seller is responsible for arranging and paying for the cost and freight necessary to transport the goods to the named destination port.

The responsibilities between the seller and the buyer are as follows:

The seller’s responsibilities under CFR include:

Arrange and pay for the cost and freight necessary to transport the goods to the named destination port.

Select and engage the carrier or transportation service provider for the transportation of the goods.

Complete export customs formalities.

Provide the necessary documents, such as the commercial invoice, packing list, and transport document, to the buyer.

Deliver the goods on board the vessel or arrange for delivery to the agreed-upon port of shipment.

The buyer’s responsibilities under CFR include:Assume responsibility for the goods once they have been delivered on board the vessel at the port of shipment.

Bear the risk of loss or damage to the goods from the time they are on board the vessel.

Arrange and pay for any subsequent transportation, including unloading the goods at the named port of destination and transporting them to the final destination.

Handle import customs clearance procedures, pay any applicable duties or taxes, and complete any necessary import formalities.

Provide the seller with any required information or documents for export or import purposes.

CIF, which stands for “Cost, Insurance, and Freight”.

Under CIF terms, the seller is responsible for arranging and paying for the transportation of the goods to the named port of destination, as well as obtaining and paying for insurance coverage against the risk of loss or damage during transit. The seller also bears the costs and risks associated with loading the goods onto the vessel.

The responsibilities between the seller and the buyer are as follows:

The seller’s responsibilities under CIF include:

Arrange and pay for the cost, insurance, and freight necessary to transport the goods to the named destination port.

Select and engage the carrier or transportation service provider for the transportation of the goods.

Complete export customs formalities.

Provide the necessary documents, such as the commercial invoice, packing list, transport document, and insurance policy or certificate, to the buyer.

Deliver the goods on board the vessel or arrange for delivery to the agreed-upon port of shipment.

The buyer’s responsibilities under CIF include:

Assume responsibility for the goods once they have been delivered on board the vessel at the port of shipment.

Bear the risk of loss or damage to the goods from the time they are on board the vessel.

Arrange and pay for any subsequent transportation, including unloading the goods at the named port of destination and transporting them to the final destination.

Handle import customs clearance procedures, pay any applicable duties or taxes, and complete any necessary import formalities.

Provide the seller with any required information or documents for export or import purposes.

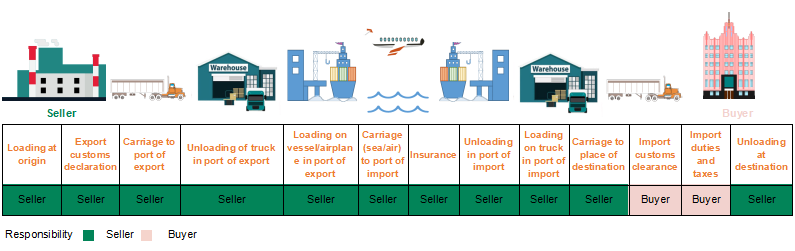

DAP, which stands for “Delivered at Place”. Under DAP terms, the seller is responsible for delivering the goods to the buyer at the named place of destination, ready for unloading.

The seller bears the risks and costs associated with transporting the goods to that destination, including any import duties, taxes, and other charges. The seller is also responsible for arranging and paying for the necessary export licenses or authorizations.

The responsibilities between the seller and the buyer are as follows:

The seller’s responsibilities under DAP include:

Deliver the goods to the destination port or terminal.

Arrange and pay for the transportation of the goods to the terminal.

Complete export customs formalities

Provide the necessary documents, such as the commercial invoice, packing list, and transport document, to the buyer.

Be responsible for any costs and risks associated with delivering the goods to the terminal, including unloading at the destination.

The buyer’s responsibilities under DAP include:

Take delivery of the goods at the named terminal or agreed-upon place of destination.

Bear the risk of loss or damage to the goods once they have been delivered at the named terminal.

Arrange and pay for any subsequent transportation, if needed, beyond the named terminal to the final destination.

Handle import customs clearance procedures, pay any applicable duties or taxes, and complete any necessary import formalities.

Provide the seller with any required information or documents for export or import purposes.

DPU stands for “Delivered at Place Unloaded” in shipping. nder DPU terms, the seller is responsible for delivering the goods to the agreed-upon destination, typically a specified location or facility, where the goods are unloaded.

The buyer is responsible for the subsequent unloading of the goods and any further transportation or handling beyond that point.

The seller’s responsibilities under DPU include:

Deliver the goods to the destination.

Arrange and pay for the transportation of the goods to the destination.

Complete export customs formalities.

Provide the necessary documents, such as the commercial invoice, packing list, and transport document, to the buyer.

Be responsible for any costs and risks associated with delivering the goods to the destination and ensuring they are ready for unloading by the buyer.

The buyer’s responsibilities under DPU include:

Take delivery of the goods at the destination.

Bear the risk of loss or damage to the goods once they have been delivered at the destination.

Unload the goods from the means of transport and handle any subsequent transportation, handling, or storage beyond the destination.

Handle import customs clearance procedures, pay any applicable duties or taxes, and complete any necessary import formalities.

Provide the seller with any required information or documents for export or import purposes.

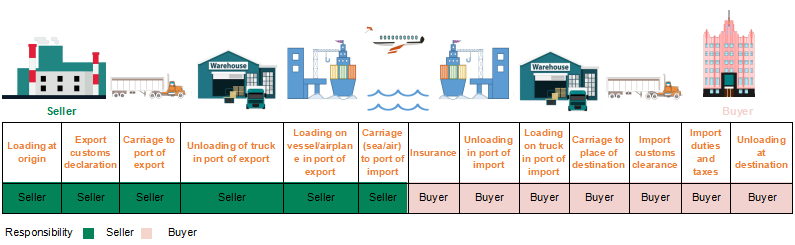

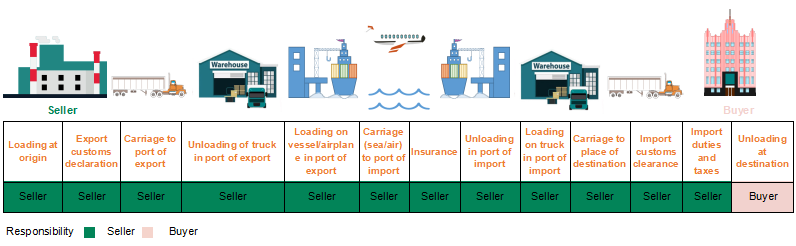

DDP stands for “Delivered Duty Paid” in shipping. Under DDP terms, the seller is responsible for delivering the goods to the buyer’s chosen destination, typically the buyer’s premises, and bearing all costs and risks associated with the import clearance, duties, and taxes.

The seller’s responsibilities under DDP include:

Deliver the goods to the destination.

Arrange and pay for the transportation of the goods to the destination.

Complete export customs formalities.

Provide the necessary documents, such as the commercial invoice, packing list, and transport document, to the buyer.

Be responsible for any costs and risks associated with delivering the goods to the agreed-upon destination and ensuring they are ready for unloading by the buyer.

The buyer’s responsibilities under DDP include:

Take delivery of the goods at the destination.

Bear the risk of loss or damage to the goods once they have been delivered at the destination.

Unload the goods from the means of transport and handle any subsequent transportation, handling, or storage beyond the destination.

Handle import customs clearance procedures, pay any applicable duties or taxes, and complete any necessary import formalities.

Provide the seller with any required information or documents for export or import purposes.

Navigating international trade can be complex, but understanding and utilizing Incoterms provide businesses with a common language and framework to facilitate smoother transactions.

By clarifying rights, responsibilities, costs, and risks, Incoterms contribute to a more efficient and transparent global trade environment. To know more about international shipping, welcome to contact DIDADI Logistic Tech to and get a free quotation if you are plan to ship!

Recommended Reading